Hello there, beautiful lovebirds! 💑 If you are ready to take your finances to the next level and secure your future together then know that saving money and building wealth as a couple is super important, but we know it can be a bit tricky at times.

Don’t worry, we’ve got your back! In this awesome guide, we’ll show you all the best strategies for saving money, setting financial goals, and making smart investments as a team.

Whether you’re living together, married, or in a committed relationship, these tips will help you build a strong financial foundation together and guide you to Saving money as a couple.

So, let’s jump right in and learn how you can save money and build wealth like a boss!

How can couples save money together? To save money together, couples can work on their financial goals and make a budget together. They should keep track of their spending, find ways to spend less, open a savings account together, and talk openly about money. These are important ways for couples to save money as a team.

- Saving Money As A Couple: Brief Description

- Setting Financial Goals As A Couple

- Creating A Joint Budget And Tracking Expenses Together: Create A Budget For A Joint Account

- Identifying Shared Expenses And Finding Ways To Split Costs Efficiently

- Sharing Expenses Equally Or Based On Individual Incomes

- Finding Creative Ways To Save Money As A Couple

- Planning For Major Expenses And Purchases Together

- Communicating Openly About Financial Matters And Priorities

- Exploring Options For Joint Savings Accounts Or Investments: Joint Bank Account

- Taking Advantage Of Discounts, Deals, And Rewards Programs As A Team

- Reflecting On Progress And Celebrating Financial Milestones Together

- Seeking Professional Financial Advice Or Counseling If Needed

- FAQ About Saving Money As A Couple

- Final Thought 💭

Saving Money As A Couple: Brief Description

Before we begin, let’s discuss why saving money as a couple is important. Saving together helps achieve shared goals like purchasing a 🏡 home, starting a 👨👩👧👦 family, or preparing for 🌅 retirement.

It provides safety and stability for your future as a couple. Saving as a team can also improve your relationship, promote better communication, and create financial security for both of you.

It’s a good idea for both spouses to contribute to retirement accounts and set up an automated system to facilitate saving for those long-range goals now.

Budget For Couples Living Together: Manage Your Money

When you and your partner live together, think about whether to keep your bank accounts or share a joint checking account.

Apps for budget for couples living together can easily manage your money, talk openly and regularly about financial decisions, set savings goals for a secure future, and create a budget that fits both of your lifestyles.

This approach helps with good financial planning and promotes honesty in managing shared expenses and savings regularly.

Following these steps can help create a more peaceful financial partnership and a stronger base for reaching your mutual financial goals.

Money Saving Challenge For Couples

Taking on a money saving challenge for couples means setting goals together and making a budget to keep track of your progress.

Work together to find ways to save money, like cutting back on eating out and choosing cheaper entertainment options.

Consider opening a joint savings or investment account to work towards long-term financial goals. Keep each other informed about your finances and make decisions together.

Celebrate every small success along the way to stay motivated toward reaching your financial dreams.

Ways To Save Money When Married

Here are some ways to save money when married:

- Set goals together for your money and make a budget together

- Find things you don’t really need and save money for the future instead

- Talk openly about money with each other

- Look for ways to make more money through side jobs or investments

- Make big decisions like buying a house or having kids together

How To Save Money With A Girlfriend?

If you are thinking about how to save money with a girlfriend then one important aspect is to maximize your savings with your partner means setting goals together, making a budget together, choosing cheap date ideas, and thinking about having shared savings account 💰, and talking openly about money to focus on saving money together 💑.

“The who trusts in his riches will fall, but the righteous will flourish like the green leaf”

Proverbs 11:28

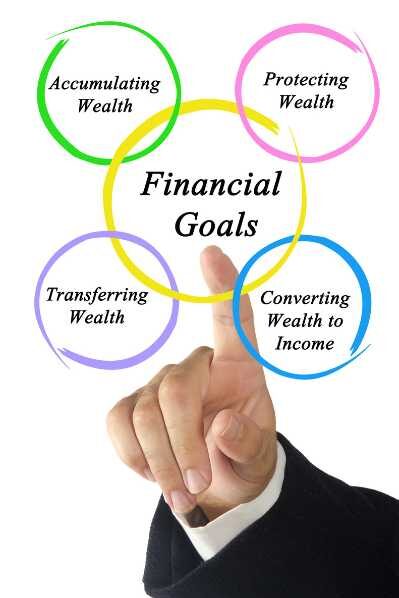

Setting Financial Goals As A Couple

Deciding on short-term and long-term money goals together helps plan for the future. Sharing financial dreams brings you closer and makes your bond stronger.

Setting small goals keeps you motivated on your money journey. Working towards your shared dreams as a team makes you feel connected.

Saving for joint projects or investments helps you reach your money goals together and has a huge impact on your overall budget.

Creating A Joint Budget And Tracking Expenses Together: Create A Budget For A Joint Account

Making a budget together that fits both of your money goals is important. Keep updating and changing the budget to make sure it still works for you.

Tracking what you both spend helps you talk openly about money. 💬 Splitting money for shared bills and personal spending, such as an allowance for each of you, helps you manage your finances. 💰 Using tools to budget makes it easier to keep track of your expenses. 📊

Identifying Shared Expenses And Finding Ways To Split Costs Efficiently

When handling money as a couple, it’s important to figure out what expenses you both share and how to divide costs fairly.

Splitting bills based on how much each of you earns can make sure things are fair financially.

Agreeing on a method for splitting expenses can help prevent arguments and keep things running smoothly.

Looking into ways to share costs can benefit both of you and make managing money easier. Being open about how you handle expenses not only helps build trust but also strengthens your financial relationship with a lot of people.

Sharing Expenses Equally Or Based On Individual Incomes

Deciding how to split expenses is important. Splitting costs evenly can make managing money easier. Dividing expenses based on how much each person makes is fair and practical.

It’s important to talk openly and agree on how to split expenses. Being flexible with sharing expenses lets you make changes as things change. 💰💑📊

Finding Creative Ways To Save Money As A Couple

If you are looking for clever ways to save money together then planning cheap date nights not only brings you closer but also saves money.

Doing DIY projects for home improvement can have a big impact on your wallet. Sharing memberships or subscriptions helps cut costs and enjoy a couple of activities.

Searching for discounts as a team not only saves money but also improves your financial situation. Facing money challenges together is a great way to strengthen your relationship and handle money problems effectively.

Additionally, setting goals and participating in couples challenges can also help improve your relationship by allowing you to spend quality time together and learn more about each other.

Planning For Major Expenses And Purchases Together

Deciding together on big money decisions is important for a good financial relationship. Talking about major purchases before making them can help avoid problems later on.

By setting goals for your money together, you can plan for your future as a couple. Working as a team on big expenses not only strengthens your financial bond but also builds trust and openness in your relationship.

Creating a budget together for major expenses ensures that you are on the same page with your money plans. 👫💸

Communicating Openly About Financial Matters And Priorities

Talking openly about money is important for a strong relationship. Having honest conversations about money goals helps partners trust each other and understand each other better.

Agreeing on financial goals ensures that both partners are on the same page. Being open about money leads to making smarter financial decisions and can also improve intimacy in the relationship.

Showing understanding and working as a team to navigate financial matters can bring couples closer together.

Exploring Options For Joint Savings Accounts Or Investments: Joint Bank Account

When you open a joint savings account with your partner, it can make managing money easier. Looking into investing together can help you build wealth.

Sharing an account encourages you both to be responsible and work towards the same financial goals.

By investing as a team, you combine your interests and make financial decisions together. Learning about savings choices as a couple can help you handle your money better.

Taking Advantage Of Discounts, Deals, And Rewards Programs As A Team

Saving money together as a couple is smart. Use discounts and deals to save more. When you join rewards programs as a team, you can save even more money.

Finding discounts as a couple helps you buy more with your budget. Working together to get deals not only saves money but also makes your finances stronger. Using rewards programs together adds value to your spending habits. 💰💑🛍️

Reflecting On Progress And Celebrating Financial Milestones Together

Looking back at how far you’ve come with your money goals is not just about the numbers; it shows how hard you’ve worked together.

Celebrating these achievements as a couple not only brings you closer but also keeps you motivated to keep going.

Remembering your progress can help you stay focused on your financial plans and the hard work you’ve put in to reach your goals.

Sharing these successful moments can make a big difference in your relationship and financial future. By celebrating these milestones together, you show your commitment to a secure financial life ahead. 🎉💑💰

Seeking Professional Financial Advice Or Counseling If Needed

Getting advice from money experts can help you make better decisions with your money. Talking to a financial counselor can help you understand how to manage your finances better.

It’s important to reach out to professionals who can give you advice that fits your situation. By asking for help when you need it, you can take steps to secure your financial future and make smart choices that match your goals.

FAQ About Saving Money As A Couple

How Much Should You Save As A Couple?

Think about saving about 20% of the money you both earn together. Make sure you have money set aside for emergencies that can cover your expenses for 3-6 months. Save at least 10-15% of your income for when you retire. Keep checking and changing your savings goals and budget as your money situation changes. The next step is to calculate how much you need to save for each category, starting with retirement and other goals. Subtract that amount from your total income to determine the amount available for discretionary spending.

What’s The Best Way To Save Money As A Couple?

Money saving as a couple is all about setting goals together, making a budget, sharing a savings account, and talking openly about money choices.

Should Couples Save Money Together?

Couples can save money together to reach financial goals. As a couple, saving money helps them work together, trust each other, and be responsible. Saving or investing as a team or money saving as a couple can help them achieve shared goals, improve communication, and strengthen their relationship.

Are Couples Who Combine Finances Happier?

Studies show that couples who pool their money together tend to trust each other more and communicate better. Sharing finances can help couples work towards common financial goals and feel more connected when managing money together. Couples need to have open and honest discussions about money issues to have a successful relationship.

Final Thought 💭

It can be understood that reaching financial stability and growing wealth as a couple requires open communication, shared goals, and new ideas.

Saving money as a couple together on budgeting, tracking spending, and finding ways to split expenses fairly can strengthen your financial foundation.

Remember to celebrate successes and ask for help from experts when needed.

Keep in mind that financial well-being is a journey best taken together, especially for those starting a new marriage. If you want more tips and advice, feel free to leave a comment below. Happy saving!

Leave a Reply